The IRS is keeping the pressure on high-income earners who fail to file tax returns, and others who may hide their earnings to avoid paying taxes. Darren Guillot, Commissioner of the IRS Small Business/Self-Employed Collection Division said the goal is to avoid (as much as possible) escalating a case to enforcement proceedings. His message on…

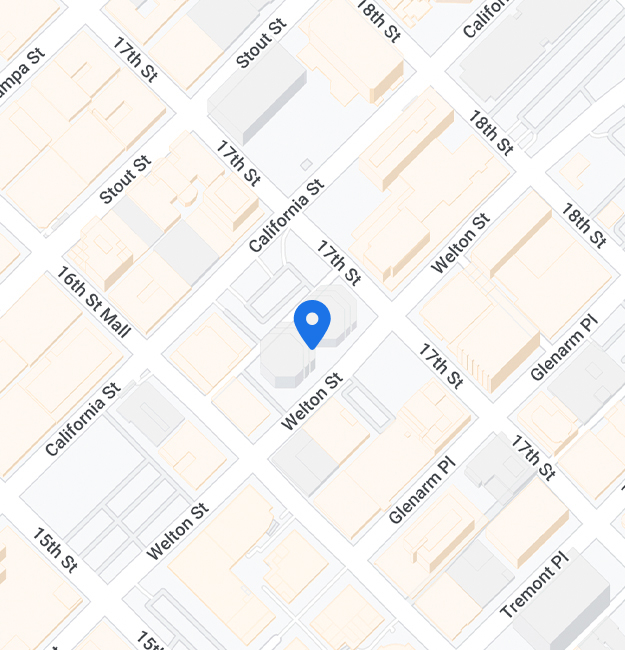

Continue reading ›Clients With IRS, Colorado,

and Local Tax Controversy

and Litigation Issues.